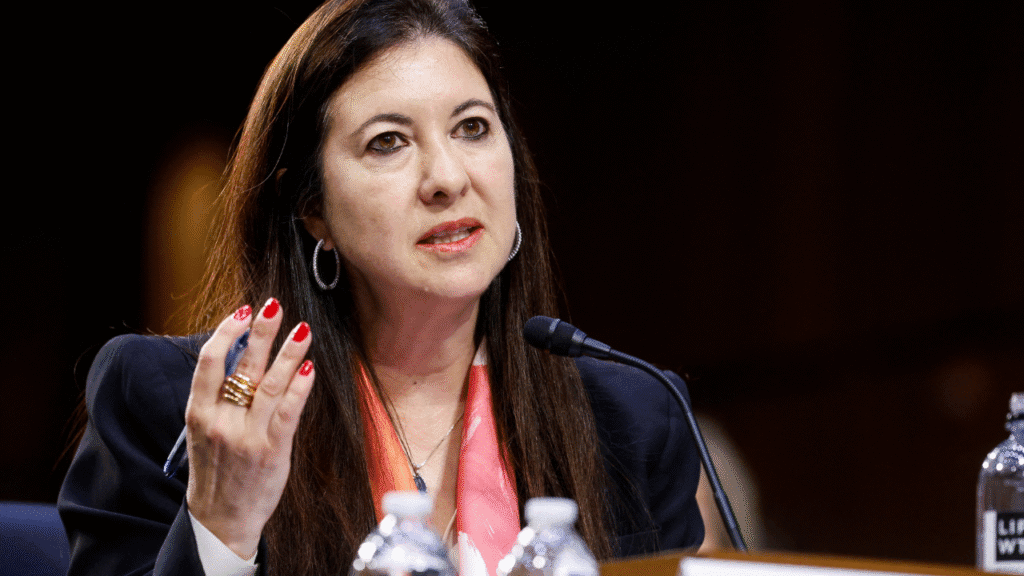

Federal Reserve Governor Adriana Kugler’s sudden resignation this November followed internal disclosures regarding improper stock trades, raising new questions about oversight and ethical standards at the nation’s central bank. According to The Wall Street Journal, Kugler stepped down after the board uncovered trades that violated the Fed’s conflict-of-interest policies, echoing similar scandals that have rocked the institution in recent years.

Improper Trades Spark Departure

Details revealed that Kugler’s transactions breached newly tightened trading restrictions meant to prevent central bank officials from profiting on market-moving news. The internal review found several trades executed during “blackout” periods when officials are prohibited from trading, as they may have access to sensitive monetary policy information. The episode has intensified calls for even stricter compliance measures at the Fed.

Broader Ethics Concerns at the Fed

Kugler is the latest in a series of high-profile departures linked to questions about personal finances and the appearance of impropriety. Previous resignations of top regional Fed officials also stemmed from disclosures of trades made at times when the central bank’s policy decisions could affect market values. Since then, the Fed has adopted more rigorous requirements on disclosure, asset restriction, and advance approvals for trades, but recent events highlight ongoing challenges.

What’s Next for the Central Bank?

Kugler’s resignation leaves a vacancy on the Fed’s influential board and reignites debate about how best to safeguard the public trust in Federal Reserve governance. While Chair Jerome Powell assures the public of continued reforms and oversight improvements, the incident underscores the importance of transparency and ethical conduct for those entrusted with guiding the nation’s monetary policy.